FAIR PRACTICES CODE

GIC Housing Finance Limited adopted Board Approved Fair Practice Code in October 2006; pursuant to the Guidelines issued by the National Housing Bank on Fair Practices Code for Housing Finance Companies vide its circular bearing No. NHB (ND)/DRS/POL- No. 16/2006 dated September 05, 2006. This Code has been modified pursuant to the Guidelines issued by the National Housing Bank on Fair Practices Code for Housing Finance Companies vide its circular bearing No.NHB (ND)/DRS/POL- No. 34/2010-11 dated October 11, 2010. The revised Code has come into force on January 29, 2011, after revised guidelines were approved by Board on January 29, 2011.

NHB has subsequently also incorporated all the above circular guidelines with certain additions in its Master Circular issued vide its Circular bearing No. NHB(ND)DRS/REG/MC-03/2017 dated July 1, 2017.

1. OBJECTIVES & APPLICATION

1.1 Objectives of the Code

This Code has been formulated by GIC Housing Finance Limited pursuant to the Guidelines issued by the National Housing Bank on Fair Practices Code for Housing Finance Companies vide its circular bearing No. NHB (ND)/DRS/POL- No. 34/2010- 11 dated October 11, 2010, as a part of best corporate practices.

The Code has been developed:-

a. To promote good & fair practices by setting reasonable Standards in dealing with Customers;

b. To increase Transparency so that the Customers can have a better understanding of what they can reasonably expect of the Services;

c. To encourage Market forces, to achieve higher Operating Standards;

d. To promote a fair & cordial relationship between Customer & GICHFL; &

e. To foster confidence in Housing Finance System.

1.2 Application of the Code

The Code applies to all the Products & Services offered by GICHFL across the counter, over the phone, by post, through interactive electronic devices or the internet, or by any other means & applies to all Offices & all Employees of GICHFL, and persons authorized to represent it in the course of its business.

2. We shall act fairly and in a transparent manner

The Company shall act fairly & reasonably in all dealings with Customers by ensuring that –

a. The Commitments & Standards prescribed in this Code are met for all Products, Services, Procedures, and Practices.

b. Our Products & Services meet relevant Laws & Regulations in letter & spirit.

c. Our dealings with Customers rest on the Ethical Principles of Integrity & Transparency.

2. 1 GICHF will transparently disclose to the borrower all information about fees/charges payable for processing the loan application, that the number of fees paid are non-refundable if the loan amount is not sanctioned/disbursed, pre-payment options and charges, if any, penalty for delayed repayment if any, conversion charges for switching loan from fixed to floating rates or vice-versa, the existence of any interest reset clause and any other matter which affects the interest of the borrower. In other words, GICHF will disclose ‘all in cost’ inclusive of all charges involved in processing/sanctioning loan applications in a transparent manner. It will also be ensured that such charges/fees are non-discriminatory.]

3. ADVERTISING, MARKETING, AND SALES

3.1 We shall

a. Ensure that all Advertising & Promotional Material is clear, & not misleading.

b. In any Advertising in any Media & Promotional Literature that draws attention to a Service or product & includes a reference to an Interest Rate, we shall also indicate whether other Fees & Charges will apply & that full details of the relevant Terms & Conditions are available on request.

c. We shall provide Information on Interest Rates, Common Fees, & Charges through Putting up Notices in all our Offices; Through Telephone or Helplines; On the Company’s Website; through designated Staff

Helpdesk; or Providing Tariff Schedule.

d. If we avail of the Services of Third Parties for providing Support Services, we shall ensure that such Third Parties handle Customer’s Personal Information (if any is available to such Third Parties) with the same degree of Confidentiality & Security as we would.

e. We may, from time to time, communicate to Customers various features of the Products availed by them. Information about our other Products or Promotional Offers in respect of Products / Services, may be conveyed to Customers only if he/she has given his / her consent to receive such Information / Service either by Mail or by registering for the same on the Website or on the Customer Service Number.

f. Prescribe a Code of Conduct for our DSAs / DST, whose Services are availed to Market Products/ services which, amongst other matters, require them to identify themselves when they approach the Customer for selling our Products.

g. In the event of receipt of any Complaint from the Customer that our Representative / Courier or DSA / DST has engaged in any improper conduct or acted in violation of this Code, appropriate steps shall be initiated to investigate & to handle the Complaint & to make good the loss.

4. LOANS

4.1 Applications for loans and their processing

We shall inform our customers of all necessary information through application forms /brochures/ Posters or during the course of meeting with the customers etc which affects the interest of the Customer. We shall provide the indicative list of documents required to be submitted along with the loan application form.

We shall follow the System of giving Acknowledgement for receipt of the Loan Application preferably along with a time frame for disposal depending upon the level of authority for sanction of the loan.

Loan Appraisal and terms/conditions

a. Normally all particulars required for processing the Loan Application shall be collected by us at the time of Application. In case we need any Additional Information, the Customer will be informed accordingly.

b. We shall convey to the Customer the Loan Sanction along with the Terms & Conditions thereof.

c. We shall provide Copies of all the Loan Documents executed by the Customer along with a Copy of each of all Enclosures quoted in the Loan Document on request.

Communication of rejection of Loan Application

If we cannot provide the Loan to the Customer, we shall communicate in writing the Reason (s) for Rejection (wherever possible).

Disbursement of Loans including changes in terms and conditions

Disbursement will be made in accordance with the disbursement schedule as per the loan agreement/ sanction letter.

Customers would be informed regarding changes to the Terms & Conditions including disbursement schedule, interest rates, service charges, prepayment charges, other applicable charges, etc. Normally, changes shall be made with Prospective Effect giving due Notice. If such change is to the disadvantage of the Customer, he/she may within 60 days & without Notice close his / her Account or switch it without having to pay any extra Charges or Interest.

Before taking a decision to recall / Accelerate Payment or Performance under the Agreement or seeking Additional Securities, we shall give Notice to Borrowers in consonance with the Loan Agreement.

We shall release all Securities on repayment of all Dues or on Realization of the Outstanding Amount of Loan subject to any Legitimate Right or Lien for any other Claim we may have against the Borrower. If such Right of Set Off is to be exercised, the Borrower shall be given Notice about the same with full particulars about the remaining Claims & the Conditions under which we are entitled to retain the Securities till the relevant Claim is settled/paid.

4.2 GUARANTORS

When a person is considering being a Guarantor for a Loan, he/she shall be informed about:

a. His / her Liability as Guarantor.

b. The amount of Liability he/she will be committing him/herself to the Company.

c. Circumstances in which we will call on him/her to pay up his / her Liability.

d. Whether we have recourse to his / her other Monies in the Company if he/she fails to pay up as a Guarantor.

e. Whether his / her Liabilities as a Guarantor are limited to a specific quantum or are unlimited.

f. Time & circumstances in which his / her Liabilities as a Guarantor will be discharged as also the manner in which we will notify him/her about this. We shall keep him / her informed of any material adverse change/s in the Financial Position of the Borrower to whom he/she stands as a Guarantor.

4.3 PRIVACY & CONFIDENTIALITY

All Personal Information of Customers shall be treated as Private and Confidential [even when the Customers are no longer Customers] and shall be guided by the following Principles & Policies. We shall not reveal Information or Data relating to Customer Accounts, whether provided by the Customers or otherwise, to anyone, including other Companies / Entities in our Group, other than in the following exceptional cases:

a. If the Information is to be given by Law.

b. If there is a duty towards the Public to reveal the Information.

c. If our interests require us to give the Information (for example, to prevent Fraud) but it should not be used as a reason for giving Information about Customer or Customer’s Accounts [including Customer Name & Address] to anyone else, including other Companies in the Group, for Marketing purposes.

d. If the Customer asks us to reveal the information, or with the Customer’s Permission.

e. If we are asked to give a reference about a Customer, we shall obtain his / her written permission before giving it.

f. The Customer shall be informed of the extent of his / her rights under the existing Legal Framework for accessing the Personal Records that we hold about him/her.

g. We shall not use Customer’s Personal Information for marketing purposes by anyone including ourselves unless the Customer specifically authorizes us to do so.

4.4 CREDIT REFERENCE AGENCIES

a. Before the opening of the loan account, we shall inform the Customer when we shall pass his / her Account details to Credit Reference Agencies & the checks we shall make with them.

b. We may give information to Credit Reference Agencies about the Personal Debts the Customer owes us if:

i. The Customer has fallen behind with his / her Payments.

ii. The Amount owed is not in dispute.

iii. The Customer has not made proposals that we are satisfied with for repaying his / her Debt, following our formal demand.

c. In these cases, we shall intimate the Customer in writing that we plan to give Information about the Debts the Customer owes us to Credit Reference Agencies. At the same time, we shall explain to the Customer the role of Credit Reference Agencies & the effect the Information they provide can have on the Customer’s ability to get Credit.

d. We may give Credit Reference Agencies other Information about the Customer’s Account if the Customer has given us his / her permission to do so.

e. A copy of the Information given to the Credit Reference Agencies shall be provided by us to a Customer if so demanded.

4.5 COLLECTION OF DUES

4.5.1 Whenever loans are given, we shall explain to the Customer the Repayment Process by way of Amount, Tenure & Periodicity of Repayment. However, if the Customer does not adhere to the Repayment Schedule, a defined Process in accordance with the Laws of the Land shall be followed for Recovery of Dues.

The Process will involve reminding the Customer by sending him / her Notice or by making Personal Visits & / or Repossession of Security, if any.

4.5.2 Our Collection Policy is built on Courtesy, Fair Treatment & Persuasion. We believe in fostering Customer confidence & long-term relationship. Our Staff or any person authorized to represent us in the Collection of Dues and / & Security Repossession shall identify himself/herself & display the Authority Letter issued by Office & upon request, display his / her Identity Card issued by the Company or under the Authority of the Company. We shall provide Customers with all the information regarding Dues & shall endeavor to give sufficient Notice for Payment of Dues.

4.5.3 All the members of the Staff or any person authorized to represent us in Collection & / or Security Repossession should follow the Guidelines set out below:

a. Customer would be contacted ordinarily at the place of his / her choice & in the absence of any specified place at the place of his / her Residence & if unavailable at his / her Residence, at the place of Business / Occupation.

b. Identity & Authority to represent the Company shall be made known to the Customer at the first instance.

c. Customer Privacy should be respected.

d. Interaction with the Customer shall be in a civil manner.

e. Our representatives shall contact the Customers between 0700 hrs & 1900 hrs, unless the special circumstances of the Customer’s Business or Occupation require otherwise.

f. Customer’s request to avoid Calls at a particular time or at a particular place shall be honored, as far as possible.

g. Time & Number of Calls & Contents of Conversation would be documented.

h. All assistance should be given to resolve disputes or differences regarding dues in a mutually acceptable & in and orderly manner.

i. During Visits to the Customer’s place for Dues Collection, Decency & Decorum shall be maintained.

j. Inappropriate occasions such as bereavement in the Family or other calamitous occasions should be avoided for making Calls / Visits to collect Dues.

4.6 COMPLAINTS & GRIEVANCES

4.6.1 Internal Procedures

a. The Company shall make available facilities at each of its offices for the customers to lodge and/or submit their complaints or grievances, if any.

b. The Company shall endeavor to address/respond to all complaints and grievances within a reasonable time and keep the customers informed about the status of their complaints. The Board of Directors will be provided with a periodical review of the compliance of the Fair Practices Code and the functioning of the grievances redressal mechanism at various levels of management.

c. Customer will be told where to find details of our Procedure for handling Complaints fairly & quickly.

d. If the Customer wants to make a complaint, he/she will be told:

Step 1 :

Customers may visit our nearest Branch, the address of which is available on our website (www.gichfindia.com). They can submit in writing and get their complaints logged in the “Complaint and Grievance Register” maintained at the Branches and available to the Branch Manager (During working hours from 9.30 A.M. to 6 P.M.)

or the customer can write an E-mail or by post/courier to the Branch Office(s) of the Company as displayed on the website (www.gichfindia.com) If a complaint has been received in writing from a customer, Company shall endeavor to send him/ her an acknowledgment/response within a period of seven (7) days from the date of complaint. The acknowledgment will be containing the name & designation of the

an official who will deal with the grievance.

Step 2:

If acknowledgment/response is not received or not satisfied with the resolution, within a period of seven(7) day’s time, Customers can write an E-mail or contact the Nodal Officer(s) of the Company.

Nodal Officer at the Corporate Office of the Company:

G I C Housing Finance Ltd, National Insurance Building, 6th floor, 14, Jamshedji Tata Road, Churchgate, Mumbai-400 020

Office: 022-22880234

E-mail ID: customer.grievances@gichf.com

After examining the complaint, we shall send the customer our final response or explain why it needs more time to respond and shall endeavor to do so within six (6) weeks.

Step 3:

If the complaint still remains unresolved, Customers may directly approach the regulatory authority of Housing Finance Companies, National Housing Bank for redressal of your complaints at the below address:

National Housing Bank,

Department of Regulation and Supervision, (Complaint Redressal Cell), 4th Floor, Core-5A, India Habitat Centre, Lodhi Road, New Delhi-110- 003

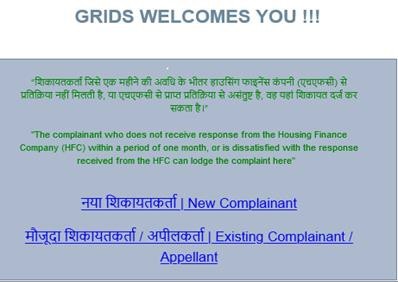

Link for filing the complaint on the NHB website:

https://grids.nhbonline.org.in

e. If a Complaint has been received in writing from a Customer, we shall send him /her Acknowledgement/ Response within a week. If the Complaint is relayed over the Phone at our designated Telephone Helpdesk or Customer Service Number, the Customer shall be provided with a Complaint Reference Number & be kept informed of the progress within a reasonable period of time.

f. After examining the matter, we shall send the Customer our Final Response or explain why it needs more time to respond & shall endeavor to do so within 6 weeks of receipt of a Complaint & he/she should be informed how to take his /her Complaint further if he/she is still not satisfied.

g. We shall publicize our grievance redressal procedure and ensure that it is specifically made available on our website.

5. General

We shall give the Customer information:-

Verify the details mentioned by him/her in the Loan Application by contacting him /her at his / her Residence & / or on Business Telephone Numbers & / or physically visiting his / her Residence & / or Business Addresses through staff or through Agencies appointed for this purpose, if deemed necessary by us.

The Customer shall be informed to cooperate if we need to investigate a Transaction on the Customer’s Account & with the Police / other Investigative Agencies if we need to involve them.

We shall advise the Customer that if the Customer acts fraudulently, he/she will be responsible for all Losses on his / her Account & that if the Customer acts without reasonable care & this causes Losses, the Customer may be held responsible for the same. Giving Customers information about our Products & Services in any of the following Languages: Hindi, English, or the appropriate local Language.

We shall not discriminate on the basis of Age, Race, Caste, Gender, Marital Status, Religion, or Disability. However, the restrictions on Age, as mentioned in our Loan Products, shall continue to apply. Each application shall be considered independently on merit, upon scrutiny of all the information, and documents required for verifying identity/entity and the security to be offered, including guarantees.

Further, we shall also not discriminate against visually impaired or physically challenged applicants on the ground of disability in extending products, services, facilities, etc..

We shall process requests for the transfer of a loan account, either from the borrower or from a bank / financial institution, in the normal course

To publicize the Code we shall

a. provide existing & new Customers with a copy of the Code;

b. make this Code available on request either over the Counter or by Electronic Communication or Mail;

c. make available this Code at each of our Offices & on our Website; &

d. ensure that our Staff is trained to provide relevant information about the Code & to put the Code into practice

.png)